Paying for goods according to the installment plan is not a new method of payment, but it has resurfaced in response to increased consumer interest. “Buy now, pay later” gives consumers more control over how much they spend and where they spend it. It also gives them more freedom to buy the things they want, even without having enough money in their account.

In the United States, point-of-sale (POS) financing services have increased significantly, particularly due to restrictions related to COVID-19. Usage among the younger demographic has greatly influenced BNPL’s growth, while banking digitalization has boosted merchant adoption.

Currently, players in the fintech market are taking the lead when it comes to BNPL, and so far only a handful of banks have reacted quickly enough to be competitive. To avoid significant losses in the future, banks need to understand the current POS financing landscape and choose a model that works best for their new customers.

New business opportunities with POS loans

Traditional banks and financial institutions should see the growth of POS funding models as a signal to rethink the lending landscape and their role in it. With fintech siphoning off most of the value of banks’ point-of-sale funding, estimated at $8-10 billion so far, it’s evident that this is a very profitable market.

Another important factor is that most users engaged in online banking are young, tech-savvy millennials and Generation Z. If banks want to see their long-term goals achieved and attract the attention of these young users , they should focus on

make these changes in the system

- Integration throughout the purchase journey

- Rethinking risk models

- Different approaches to credit

Integration throughout the purchase journey

As fintech works to create a complete customer buying journey, banks are falling behind. Onboarding can help scale and inspire younger generations to give banks greater visibility. Using rewards and subsidizing credit reward costs will bring more value to customers and ultimately increase their loyalty.

Rethinking risk models

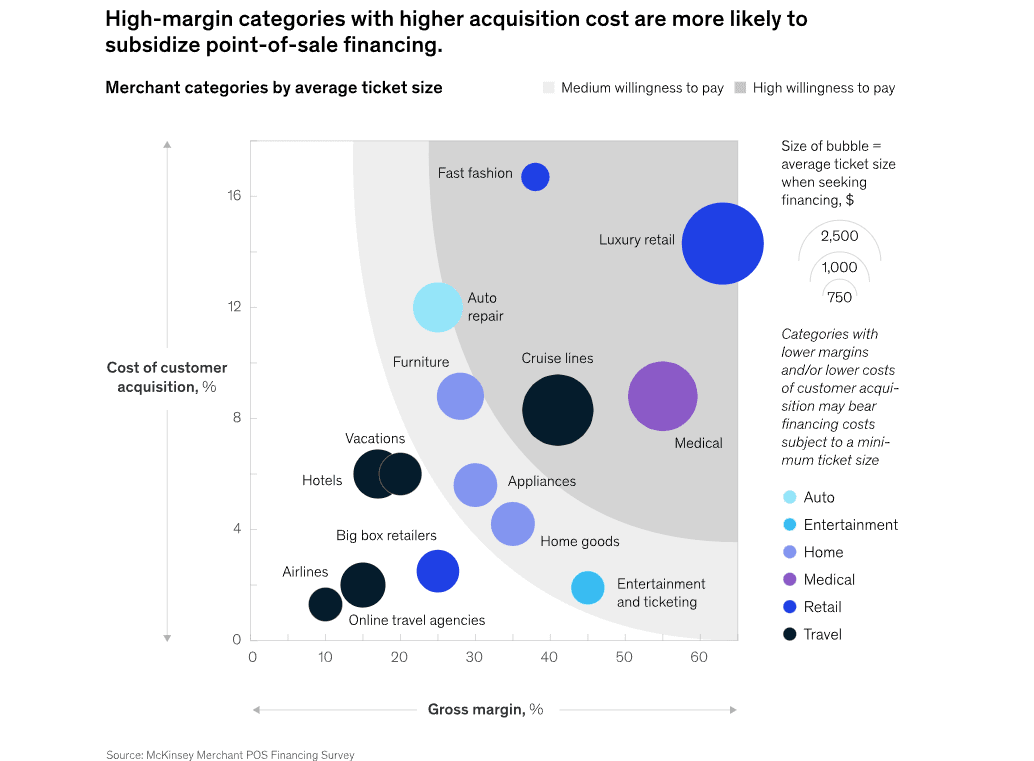

Consumer expectations are increasing every day, especially with merchant subsidies. It is time for banks to rethink and update their risk models to meet these expectations. One possible solution could be merchant partnerships, as merchants play a key role as intermediaries in this model.

Different approaches to credit

The difference between traditional credit products, installment credit cards and debit cards with new features is becoming increasingly blurred. Banks that start offering credit products in the format their customers want will gain valuable benefits and profit.

Everyone, whether neobanks, card issuers, lenders or merchant acquirers, are competing for market share. By offering BNPL options, they can see how users interact with their platforms and find the right business model to stay afloat in a dynamic market.

It is clear that Buy Now, Pay Later is growing rapidly. Indeed, results from McKinsey’s 2021 Digital Payments Survey suggest that BNPL usage may actually be growing faster than its penetration.

Distinct models Buy now, pay later

As not all POS systems work the same way, the description of the systems used in the different financial markets shows how the service has evolved over a short period of time. At the same time, banks can gain a better understanding of what they are competing against and how they could outperform it.

1. Finance midsize purchases with off-card solutions

Solutions like Uplift and Affirm, which allow you to repay in monthly installments, are ideal for small and medium purchases. On average, the note size is between $250 and $2,500 and the time to repay the loan is around 8-9 months. Products purchased in this way are typically appliances, electronics, home fitness equipment, and furniture.

Most of these transactions are done digitally, and their growth is fueled by increased adoption among users with higher credit scores. However, consumers are unlikely to use this financing strategy more than a few times per year.

2. Post-Purchase Card Payments

This financing solution is popular in Asia and Latin America, although adoption rates are still quite low in the United States. Since the post-purchase refund strategy has a higher APR than other point-of-sale purchase solutions, it is less popular. However, a big advantage after purchase is the ability for merchants to use it with special offers. Card-linked payouts are currently available through services like Splitit or network solutions like Visa Payouts.

3. Shopping App Integration

The aspiration of most major shopping apps is to become “super apps”. Major market players such as PayPal’s “Pay In 4” offer services that follow customers throughout the purchase journey. Moreover, they are gradually gaining momentum. Unless banks find a way to increase their exposure, they might not be competitive at the same level and expect to suffer losses in the near future.

Pay in 4 focuses on small purchases that are typically under $250, with installments users can pay off in six weeks. Services like Afterpay have seen phenomenal growth fueled by the pandemic lockdown. With more merchants integrating these products into their payment offerings, the increase of more than 300% in 2020 could prove to be even greater in 2021. McKinsey estimates that Pay in 4 could generate between $4 and $6 billion in revenue by 2023.

Major market players recognize this trend towards integration. To secure their market positions, many have decided to integrate Etsy.com with Klarna and Houzz.com with Afterpay.

Why Consumers Use BNPL

Convenience. BNPL loans require a down payment or “down payment”, for example 25% of the purchase amount. The remaining amount is then repaid in installments over a few weeks or months.

Zero or low interest rate. BNPL loans do not include additional interest or bank charges, but they can come with a fixed repayment schedule.

Flexible credit check. To prevent fraudulent behavior, a soft credit check is performed to confirm the buyer’s identity. There will be no credit check or underwriting in the process.

Easy approval process. One of the most popular features of BNPL is the quick and easy approval process. Not only does this not affect credit scores, but it is irrelevant to other creditors.

How Banks Can Leverage POS Financing

Banks interested in getting involved in POS financing solutions can choose from different financing models. Each presents a unique opportunity as it forces banks to understand cost, time to market and customer segmentation.

Lease your balance to a BNPL company

One of the examples of collaboration between banks and BNPL companies is the model chosen by Cross River Bank and Affirm. Cross River provides Affirm with banking services so that they can endorse microfinance solutions.

Integrate credit card payments

As the BNPL market continues to grow, some banks have decided to integrate installments with existing credit cards. JP Morgan has developed Citi Flex Pay & Chase Pan to allow its customers to reimburse their purchases in installments. The strategy of adding new features to existing products or developing new financing products is a good way to meet customer needs, especially since most of them have started using alternative financing options. to avoid paying exorbitant interest on credit cards.

Take over a BNPL company

The market value of some of BNPL’s biggest players is estimated to be in the billions of dollars. AfterPay and Klarna have grown so much that even well-known market players like Mastercard, Apple Pay and Goldman Sachs have decided to offer new ways to use installments. However, as a stand-alone model, BNPL does not appear to be viable.

Develop your own BNPL solution

Some banks and financial institutions are ready to meet the needs of their customers and offer in-house developed POS financing solutions. If they want to compete with fintech, their advantage could be a partnership that allows them to build a unique product with the bespoke features their customers need.

Last word

Traditional lenders, brick-and-mortar banks, and neo-banks are all scrambling to find their footing in the POS financing market. Fierce competition will force them to use their assets to fuel the right business models and enter the market with competitive products.

What we can be certain of is the underlying need that drives customers and how point-of-sale financing addresses it. The digitization of major banking systems prevents some commercial banks from implementing clear strategies to enter this market. But with the ever expanding market scale, POS financing is here to stay.